FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Last updated 01 abril 2025

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Smart Money Podcast: Retirement Planning Guide: Estate Planning, Social Security, Long-Term Care and Medicare Explained - NerdWallet

Self-Employment Taxes and SECA: Complete Guide

Driving progress at NerdWallet — and beyond - NerdWallet

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

IRS Form 941: How to File Quarterly Tax Returns - NerdWallet

Federal Insurance Contributions Act: FICA - FasterCapital

What is FICA Tax? - The TurboTax Blog

How LLCs Pay Taxes - NerdWallet

Restricted Stock Units: What You Need to Know About RSUs - NerdWallet

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions01 abril 2025

-

FICA Tax: What It is and How to Calculate It01 abril 2025

FICA Tax: What It is and How to Calculate It01 abril 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202301 abril 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202301 abril 2025 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations01 abril 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations01 abril 2025 -

Do You Have To Pay Tax On Your Social Security Benefits?01 abril 2025

Do You Have To Pay Tax On Your Social Security Benefits?01 abril 2025 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social01 abril 2025

-

What Is FICA Tax, Understanding Payroll Tax Requirements01 abril 2025

What Is FICA Tax, Understanding Payroll Tax Requirements01 abril 2025 -

FICA Tax & Who Pays It01 abril 2025

FICA Tax & Who Pays It01 abril 2025 -

Keyword:current fica tax rate - FasterCapital01 abril 2025

Keyword:current fica tax rate - FasterCapital01 abril 2025 -

What are FICA Taxes? Social Security & Medicare Taxes Explained01 abril 2025

você pode gostar

-

☆ Miyabi ☆ Zetsurin Yurei ga Iku made Tsuitekuru by Okonogi Happa #fyp01 abril 2025

-

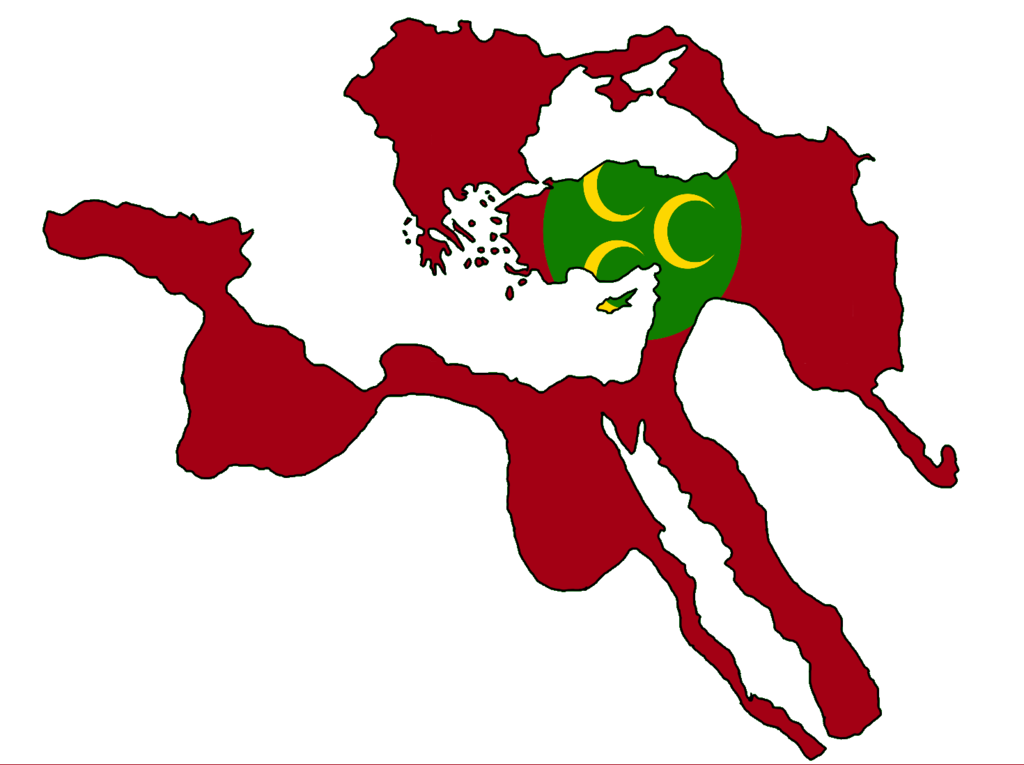

File:Flag-map of Ottoman Empire Greatest Extent.png - Wikimedia01 abril 2025

File:Flag-map of Ottoman Empire Greatest Extent.png - Wikimedia01 abril 2025 -

Competitivo Fortnite Zone01 abril 2025

Competitivo Fortnite Zone01 abril 2025 -

Velório do cantor Cristiano Araújo - 24/06/2015 - F5 - Fotografia - Folha de S.Paulo01 abril 2025

Velório do cantor Cristiano Araújo - 24/06/2015 - F5 - Fotografia - Folha de S.Paulo01 abril 2025 -

College Football Champs: Auburn In A Close One01 abril 2025

College Football Champs: Auburn In A Close One01 abril 2025 -

anime: Koisuru Asteroid #koisuruasteroid #anime #recomendaçãodeanime #01 abril 2025

-

30 exemplos incríveis de concursos no Facebook feitos da maneira certa01 abril 2025

30 exemplos incríveis de concursos no Facebook feitos da maneira certa01 abril 2025 -

Bispo Bruno Leonardo e o poder da oração do Salmo 9101 abril 2025

Bispo Bruno Leonardo e o poder da oração do Salmo 9101 abril 2025 -

Railroad Tycoon - Wikipedia01 abril 2025

Railroad Tycoon - Wikipedia01 abril 2025 -

Portal de Serviços Digitais01 abril 2025

Portal de Serviços Digitais01 abril 2025