FICA Tax & Who Pays It

Por um escritor misterioso

Last updated 27 abril 2025

FICA taxes are mandated payroll taxes that benefit federal insurance programs. In this article, we are discussing what FICA taxes are, how they’re paid, and what they mean for employers and employees. Looking for information on

What is FICA Tax? - The TurboTax Blog

FICA explained: Social Security and Medicare tax rates to know in 2023

Federal Insurance Contributions Act - Wikipedia

How to Pay Payroll Taxes Step-by-step Guide for Employers

What Are FICA Taxes And Do They Affect Me?, by M. De Oto

.jpeg)

Understanding Your Paycheck Withholdings

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

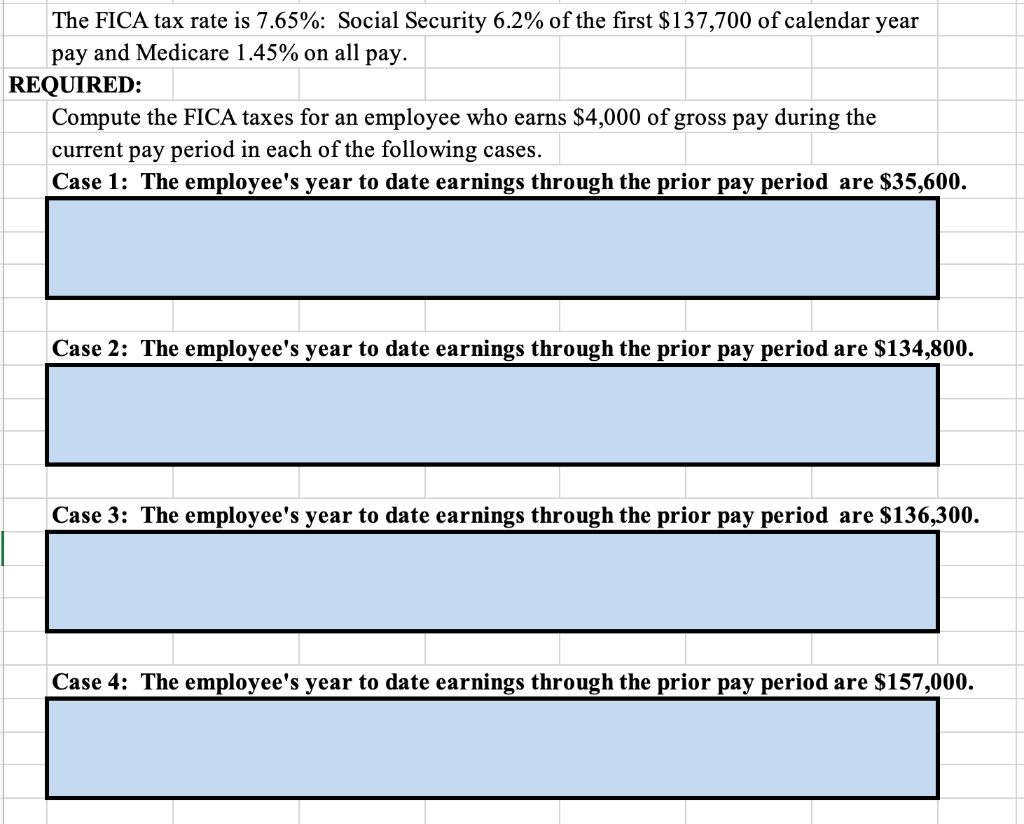

Solved The FICA tax rate is 7.65%: Social Security 6.2% of

Withholding FICA Tax on Nonresident employees and Foreign Workers

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions27 abril 2025

-

What is Fica Tax?, What is Fica on My Paycheck27 abril 2025

What is Fica Tax?, What is Fica on My Paycheck27 abril 2025 -

Historical Social Security and FICA Tax Rates for a Family of Four27 abril 2025

Historical Social Security and FICA Tax Rates for a Family of Four27 abril 2025 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand27 abril 2025

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand27 abril 2025 -

Employee Social Security Tax Deferral Repayment27 abril 2025

Employee Social Security Tax Deferral Repayment27 abril 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review27 abril 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review27 abril 2025 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime27 abril 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime27 abril 2025 -

How An S Corporation Reduces FICA Self-Employment Taxes27 abril 2025

How An S Corporation Reduces FICA Self-Employment Taxes27 abril 2025 -

2017 FICA Tax: What You Need to Know27 abril 2025

2017 FICA Tax: What You Need to Know27 abril 2025 -

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) What Is Social Security Tax? Definition, Exemptions, and Example27 abril 2025

What Is Social Security Tax? Definition, Exemptions, and Example27 abril 2025

você pode gostar

-

NUANÇAS, por Amaury Barroso - Clube de Autores27 abril 2025

NUANÇAS, por Amaury Barroso - Clube de Autores27 abril 2025 -

is1-ssl.mzstatic.com/image/thumb/Purple122/v4/11/527 abril 2025

is1-ssl.mzstatic.com/image/thumb/Purple122/v4/11/527 abril 2025 -

![When will be Redo of Healer Season 2 Released? [Latest Updates]](https://editorialge.com/wp-content/uploads/2023/02/Redo-of-Healer-Season-2.jpeg) When will be Redo of Healer Season 2 Released? [Latest Updates]27 abril 2025

When will be Redo of Healer Season 2 Released? [Latest Updates]27 abril 2025 -

Superstar Night - Get ready for THE MOST Inspiring & Uplifting27 abril 2025

Superstar Night - Get ready for THE MOST Inspiring & Uplifting27 abril 2025 -

Classic Sonic Heroes mod - ModDB27 abril 2025

Classic Sonic Heroes mod - ModDB27 abril 2025 -

Camp Half-Blood Logo Mat Rug Carpet Anti-Slip Bedroom Entrance Door Mat Percy Jackson Camp Half Blood Pjo - AliExpress27 abril 2025

Camp Half-Blood Logo Mat Rug Carpet Anti-Slip Bedroom Entrance Door Mat Percy Jackson Camp Half Blood Pjo - AliExpress27 abril 2025 -

Eurogamer.net Podcast #9827 abril 2025

Eurogamer.net Podcast #9827 abril 2025 -

Linhas retas e paleta neutra marcam apartamento moderno de 135 m² - Casa e Jardim27 abril 2025

Linhas retas e paleta neutra marcam apartamento moderno de 135 m² - Casa e Jardim27 abril 2025 -

Fall Red Stickman — play online for free on Yandex Games27 abril 2025

-

ArtStation - Mono (Little Nightmares 2 Fanart)27 abril 2025

ArtStation - Mono (Little Nightmares 2 Fanart)27 abril 2025