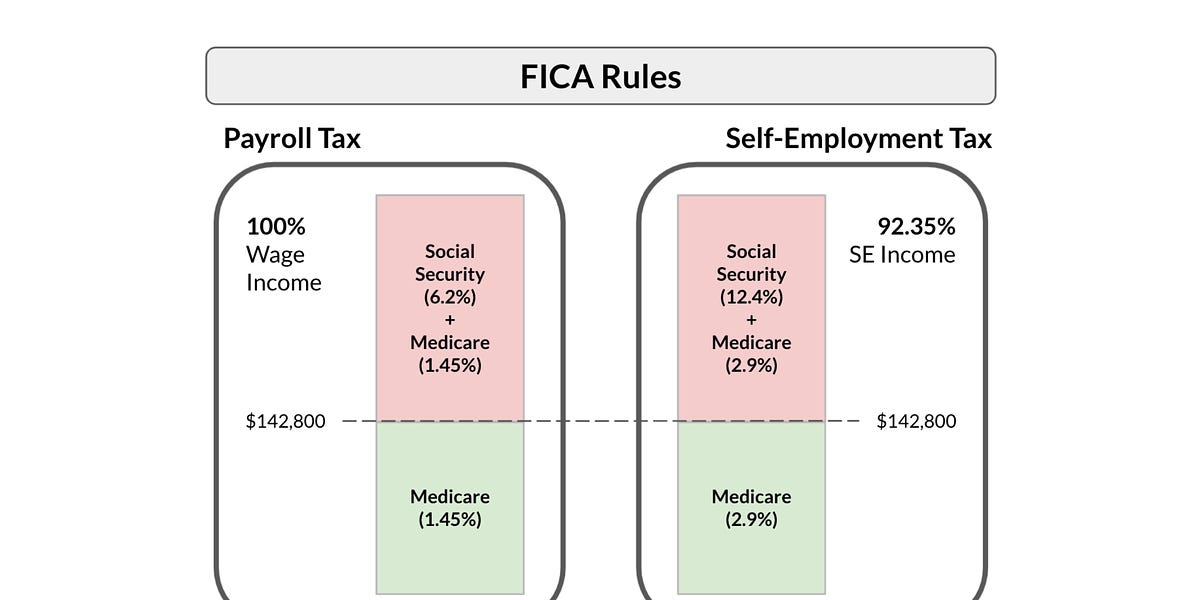

Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Last updated 28 março 2025

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Payroll tax in Texas: What employers need to know

How An S Corporation Reduces FICA Self-Employment Taxes

Federal Insurance Contributions Act - Wikipedia

What Is the FICA Tax?, Retirement

Federal Insurance Contributions Act - Wikipedia

Wage Base Limit - FasterCapital

What are FICA Taxes? 2022-2023 Rates and Instructions

Learn About FICA Tax and How To Calculate It

Payroll Tax - by Allen Osgood - Wealthjoy

Understanding Your Paycheck

What are FICA Taxes? 2022-2023 Rates and Instructions

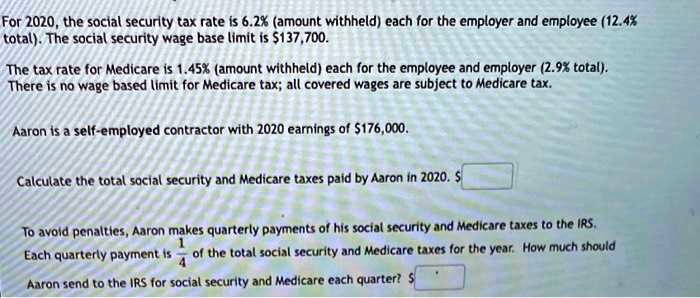

SOLVED: For 2020, the social security tax rate is 6.2% (amount

Understanding Your Tax Forms: The W-2

Employee Retention Credit - Anfinson Thompson & Co.

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog28 março 2025

-

What is FICA tax?28 março 2025

What is FICA tax?28 março 2025 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?28 março 2025

Family Finance Favs: Don't Leave Teens Wondering What The FICA?28 março 2025 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes28 março 2025

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes28 março 2025 -

What is the FICA Tax Refund?28 março 2025

What is the FICA Tax Refund?28 março 2025 -

Do You Have To Pay Tax On Your Social Security Benefits?28 março 2025

Do You Have To Pay Tax On Your Social Security Benefits?28 março 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software28 março 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software28 março 2025 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social28 março 2025

-

What Is FICA Tax, Understanding Payroll Tax Requirements28 março 2025

What Is FICA Tax, Understanding Payroll Tax Requirements28 março 2025 -

What are FICA Taxes? Social Security & Medicare Taxes Explained28 março 2025

você pode gostar

-

Obtenha páginas para colorir LOL Surprise para imprimir gratuitamente28 março 2025

Obtenha páginas para colorir LOL Surprise para imprimir gratuitamente28 março 2025 -

Kit Conjunto 3 Bonecos Dragon Ball Z dbz Super Goku Super Sayajin28 março 2025

Kit Conjunto 3 Bonecos Dragon Ball Z dbz Super Goku Super Sayajin28 março 2025 -

CAMPEONATO MUNDIAL DE CLUBES 2019 QUEM FOI CAMPEÃO? DESAFIOS DE28 março 2025

CAMPEONATO MUNDIAL DE CLUBES 2019 QUEM FOI CAMPEÃO? DESAFIOS DE28 março 2025 -

Em lançamento de uniformes do Botafogo, Jairzinho valoriza atual28 março 2025

Em lançamento de uniformes do Botafogo, Jairzinho valoriza atual28 março 2025 -

How Artificial Intelligence is Changing the Game of Poker28 março 2025

How Artificial Intelligence is Changing the Game of Poker28 março 2025 -

Qual o melhor curso de inglês para conversação? - Mundo Graduado28 março 2025

Qual o melhor curso de inglês para conversação? - Mundo Graduado28 março 2025 -

Mega Mewtwo Y28 março 2025

-

Super Animes APK v2.0 Download grátis - Assistir filmes 202328 março 2025

Super Animes APK v2.0 Download grátis - Assistir filmes 202328 março 2025 -

The Strokes - You Only Live Once ~ Español/Lyrics28 março 2025

The Strokes - You Only Live Once ~ Español/Lyrics28 março 2025 -

Honzuki no Gekokujou regresa con una 4 temporada y WIT Studio al28 março 2025

Honzuki no Gekokujou regresa con una 4 temporada y WIT Studio al28 março 2025