Useful Life Definition and Use in Depreciation of Assets

Por um escritor misterioso

Last updated 31 março 2025

:max_bytes(150000):strip_icc()/Useful-life-Recirc-blue-d6507e2b75df4077b3f5e31d07f2344e.jpg)

The useful life of an asset is an estimate of the number of years it is likely to remain in service for the purpose of cost-effective revenue generation.

What is the 75% economic life threshold in determining whether is a lease is finance or operating? - Universal CPA Review

:max_bytes(150000):strip_icc()/Economic-Life-Final-cf7a1c9355b341cdb07c4766fb63057d.jpg)

Economic Life: Definition, Determining Factors, Vs. Depreciation

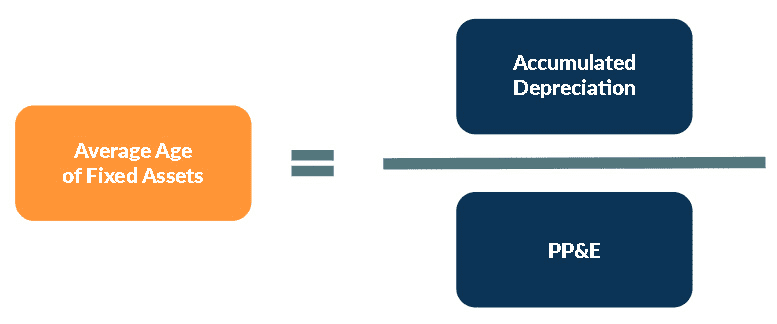

Fixed Asset Accounting Explained w/ Examples, Entries & More

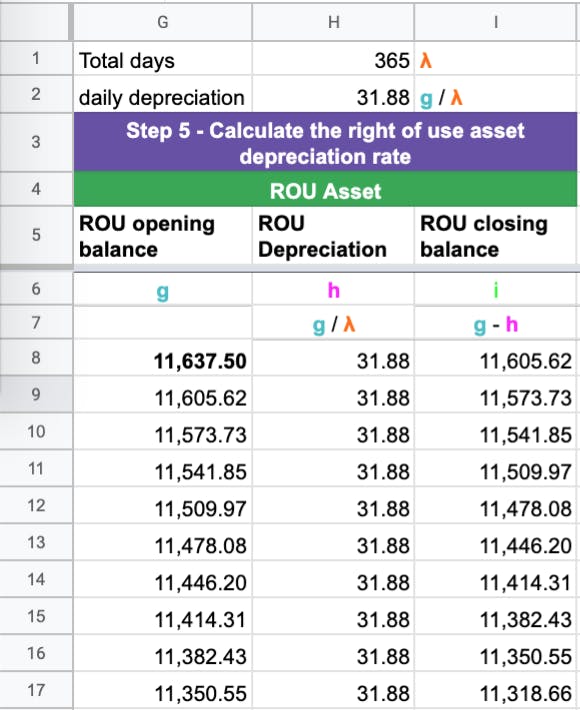

How to calculate a lease liability and right-of-use asset under IFRS 16

What is Depreciation of Assets and How Does it Impact Accounting?

Is Depreciation an Operating Expense? - Akounto

Publication 946 (2022), How To Depreciate Property

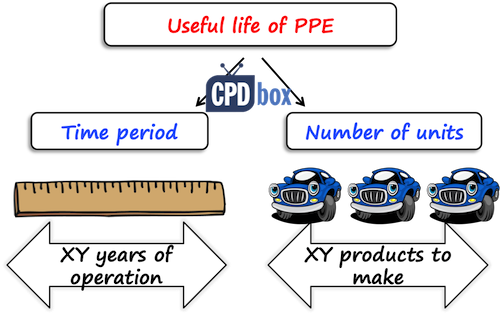

Different useful lives of PPE

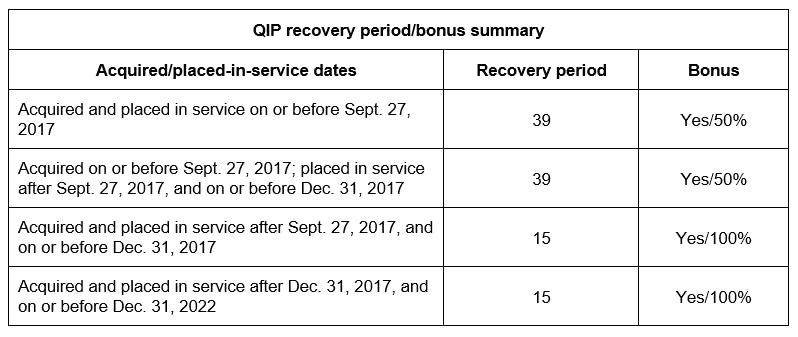

Bonus depreciation rules, recovery periods for real property and expanded section 179 expensing - Baker Tilly

Depreciation: Accounting for Depreciation in Capital Budgeting - FasterCapital

Depreciable Asset Lives - The CPA Journal

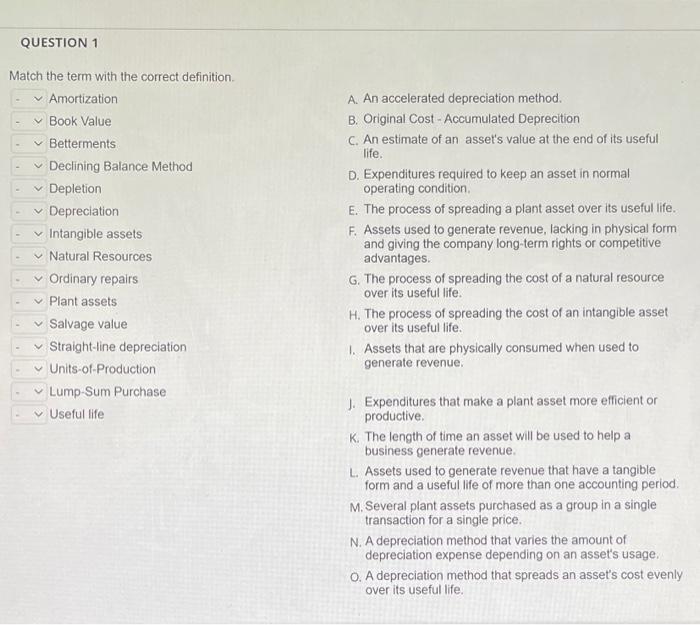

Solved QUESTION 1 Match the term with the correct definition

Different Methods of Depreciation Calculation

Recomendado para você

-

Half-Life (video game) - Wikipedia31 março 2025

Half-Life (video game) - Wikipedia31 março 2025 -

Half-Life (series) - Wikipedia31 março 2025

Half-Life (series) - Wikipedia31 março 2025 -

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg) Term Life Insurance: What It Is, Different Types, Pros and Cons31 março 2025

Term Life Insurance: What It Is, Different Types, Pros and Cons31 março 2025 -

A very tough top 50 to make #futuresongs #future #playlist #songs #rap, sorry future31 março 2025

-

Sometimes a Great Notion 1971 LETTERBOXED LASERDISC- Paul Newman Henry Fonda VG31 março 2025

Sometimes a Great Notion 1971 LETTERBOXED LASERDISC- Paul Newman Henry Fonda VG31 março 2025 -

Does discard in this case mean from the hand? Or the top of the library? Also, where do i put this enchantment? On my battlefield or on one of my creatures?31 março 2025

Does discard in this case mean from the hand? Or the top of the library? Also, where do i put this enchantment? On my battlefield or on one of my creatures?31 março 2025 -

Oculus founder says his new VR headset will kill people if they die in game - India Today31 março 2025

Oculus founder says his new VR headset will kill people if they die in game - India Today31 março 2025 -

Checklist #72 The Osbournes 2002 Inkworks Trading Card31 março 2025

Checklist #72 The Osbournes 2002 Inkworks Trading Card31 março 2025 -

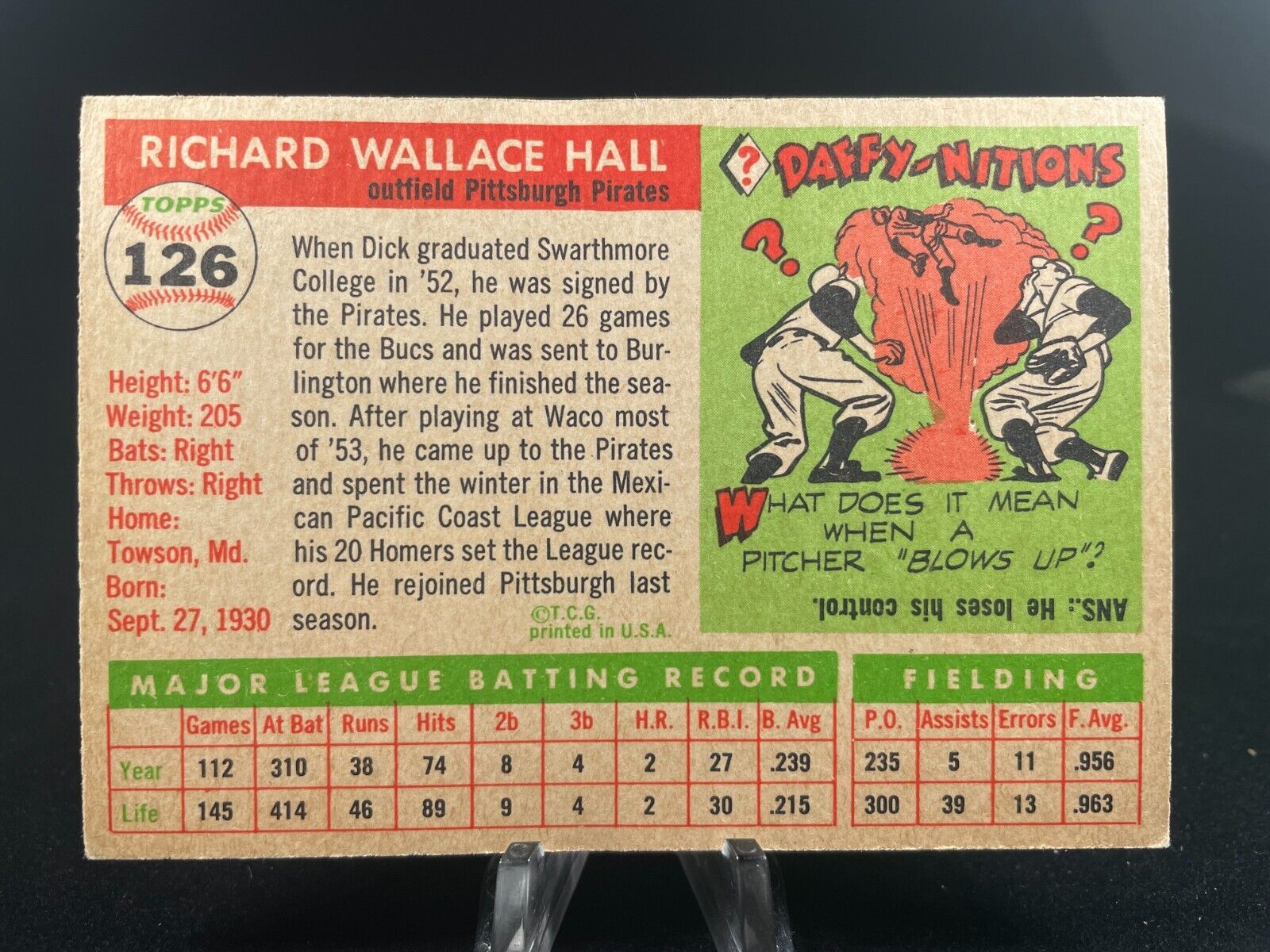

1955 Topps Baseball Dick Hall #126 Pittsburgh Pirates31 março 2025

1955 Topps Baseball Dick Hall #126 Pittsburgh Pirates31 março 2025 -

Nintendo Switch Online - Every NES, SNES, N64, Sega Genesis, Game Boy, And GBA Game Available31 março 2025

Nintendo Switch Online - Every NES, SNES, N64, Sega Genesis, Game Boy, And GBA Game Available31 março 2025

você pode gostar

-

Stream DJ Ritmo55 Listen to JOGO DE FOGO playlist online for31 março 2025

Stream DJ Ritmo55 Listen to JOGO DE FOGO playlist online for31 março 2025 -

Panels of Interest on Tumblr31 março 2025

Panels of Interest on Tumblr31 março 2025 -

Shift Power Onix 13/19 - Chip Acelerador Faaftech31 março 2025

Shift Power Onix 13/19 - Chip Acelerador Faaftech31 março 2025 -

Roblox Err smile face by NeviWafers on DeviantArt31 março 2025

Roblox Err smile face by NeviWafers on DeviantArt31 março 2025 -

Jogos de Operate Now no Jogos 36031 março 2025

Jogos de Operate Now no Jogos 36031 março 2025 -

Assistir Megami no Café Terrace ep 12 - FINAL - Anitube31 março 2025

Assistir Megami no Café Terrace ep 12 - FINAL - Anitube31 março 2025 -

Second Life Marketplace - (LCD-Anato) Metal Sonic Avatar31 março 2025

Second Life Marketplace - (LCD-Anato) Metal Sonic Avatar31 março 2025 -

PROVANDO os NOVOS CHEETOS CRUNCHY fazendo LIVE DE NPC31 março 2025

PROVANDO os NOVOS CHEETOS CRUNCHY fazendo LIVE DE NPC31 março 2025 -

STOP SAYING “I'M FINE!” Reply This to HOW ARE YOU?31 março 2025

STOP SAYING “I'M FINE!” Reply This to HOW ARE YOU?31 março 2025 -

Joia ou Jóia: A palavra joia tem acento?31 março 2025

Joia ou Jóia: A palavra joia tem acento?31 março 2025