Itemize - Home

Por um escritor misterioso

Last updated 21 dezembro 2024

Itemize automates B2B financial document processing, enhances risk assessment, and helps approve transactions via streamlined information flows and improved business intelligence.

Are Home Improvements Tax-Deductible? The Rules Explained, with Examples

Can I Deduct That Home Office Shed in My Backyard?

Solved) - A self-employed taxpayer who itemized deductions owns a home, of (1 Answer)

Can I include interest payments as an itemized deduction? - Universal CPA Review

Standard Deduction Vs Itemized Deductions: Which Is Better?

Can You Deduct Your Home Office on Your Taxes?

Airbnb Tax Deductions Short Term Rental Tax Deductions

Publication 587 (2022), Business Use of Your Home

How To Itemize Deductions Like a Tax Pro

How Will the New Tax Bill Affect Housing Costs in the Eastern Sierra – Inyo County & Mono County Real Estate

Recomendado para você

-

AP Automation & Audits Fight Fraud - Stampli21 dezembro 2024

AP Automation & Audits Fight Fraud - Stampli21 dezembro 2024 -

QuickBooks Invoice Forms with Perforated Payment Voucher21 dezembro 2024

QuickBooks Invoice Forms with Perforated Payment Voucher21 dezembro 2024 -

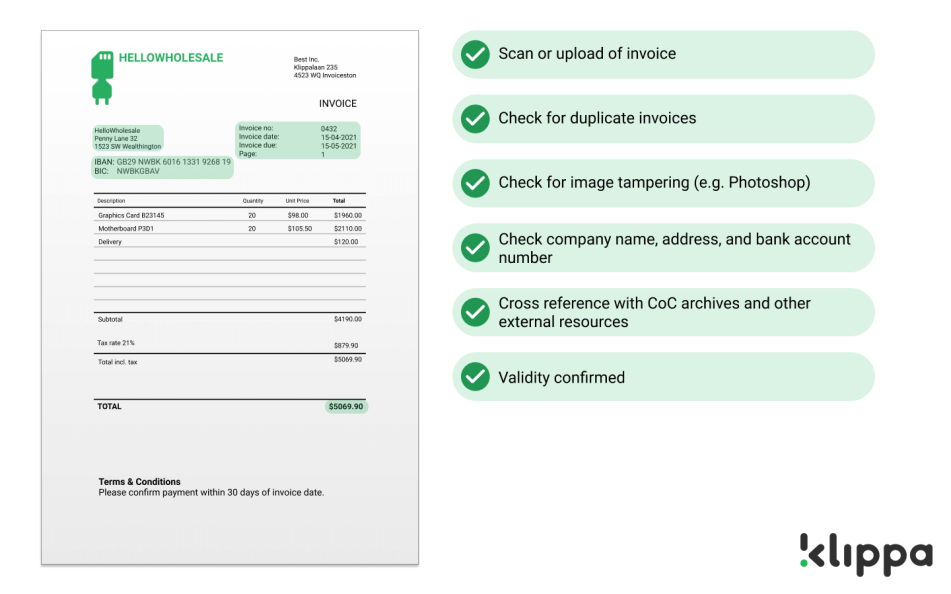

5 reasons to automate your factoring back office - Klippa21 dezembro 2024

5 reasons to automate your factoring back office - Klippa21 dezembro 2024 -

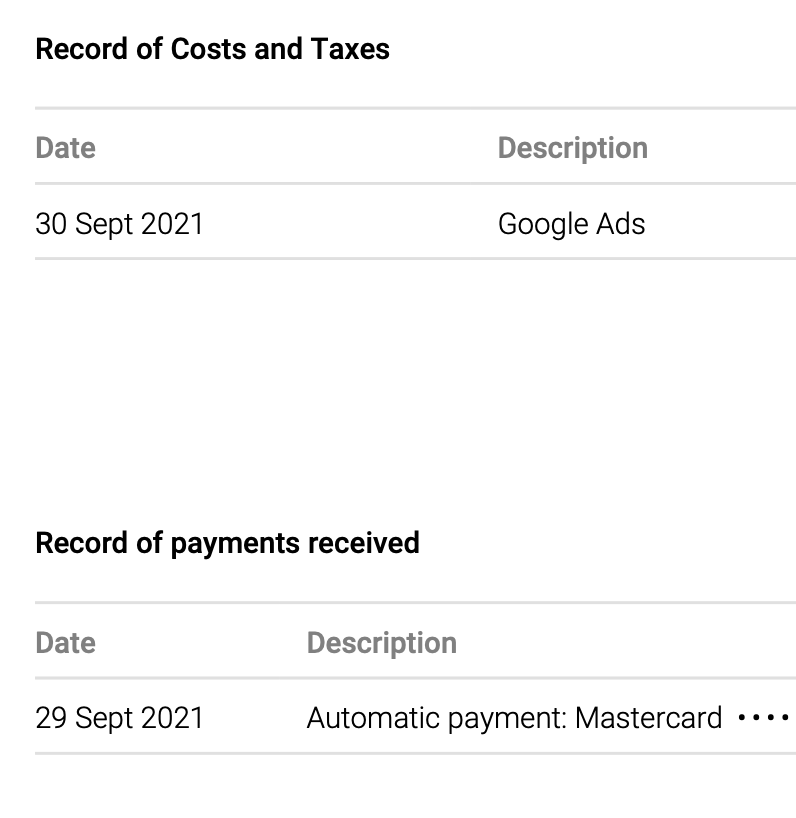

Where can I find a tax invoice as was available prior to October? - Google Ads Community21 dezembro 2024

Where can I find a tax invoice as was available prior to October? - Google Ads Community21 dezembro 2024 -

Duplicate Invoice Check Part 1, PDF, Invoice21 dezembro 2024

-

2-Way vs. 3-Way Matching: What's the Difference? - AvidXchange21 dezembro 2024

2-Way vs. 3-Way Matching: What's the Difference? - AvidXchange21 dezembro 2024 -

Freight Payment: Freight Invoice Facts You Should Know - GoComet21 dezembro 2024

Freight Payment: Freight Invoice Facts You Should Know - GoComet21 dezembro 2024 -

Rukmani R on LinkedIn: How Credit Note can be processed? 1.Make sure you are receiving proper…21 dezembro 2024

-

Free Purchase Order (PO) Template21 dezembro 2024

Free Purchase Order (PO) Template21 dezembro 2024 -

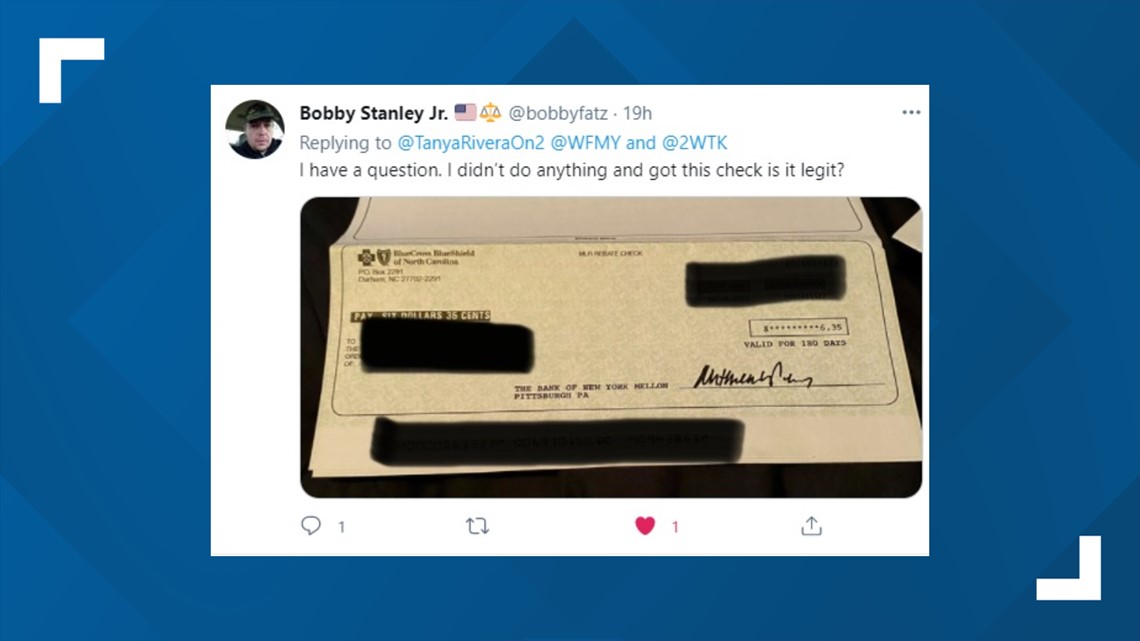

BCBS is sending out rebate checks. Find out why.21 dezembro 2024

BCBS is sending out rebate checks. Find out why.21 dezembro 2024

você pode gostar

-

Konosuba Megumin Spin-Off Anime Confirms Release21 dezembro 2024

Konosuba Megumin Spin-Off Anime Confirms Release21 dezembro 2024 -

PEGUEI TOP GLOBAL GLADIADORES FF RANQUEADO EM 3 HORAS SEASON 321 dezembro 2024

PEGUEI TOP GLOBAL GLADIADORES FF RANQUEADO EM 3 HORAS SEASON 321 dezembro 2024 -

Pokemon GO Type Chart: Best Pokemon to chose for gym battles21 dezembro 2024

Pokemon GO Type Chart: Best Pokemon to chose for gym battles21 dezembro 2024 -

The rake roblox fit|TikTok Search21 dezembro 2024

The rake roblox fit|TikTok Search21 dezembro 2024 -

Brutally Action-Packed Trailer for Tony Jaa's Martial Arts Film21 dezembro 2024

Brutally Action-Packed Trailer for Tony Jaa's Martial Arts Film21 dezembro 2024 -

playing robloz kaiju paradise with happymod (liteapks).21 dezembro 2024

playing robloz kaiju paradise with happymod (liteapks).21 dezembro 2024 -

Bleach Online: Ascension Hero21 dezembro 2024

-

Altrincham FC Archived News21 dezembro 2024

-

shiny zapdos price|TikTok Search21 dezembro 2024

shiny zapdos price|TikTok Search21 dezembro 2024 -

Palpite Ferro Carril Oeste x Gimnasia Jujuy: 18/06/2023 - 2º21 dezembro 2024

Palpite Ferro Carril Oeste x Gimnasia Jujuy: 18/06/2023 - 2º21 dezembro 2024