Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 29 março 2025

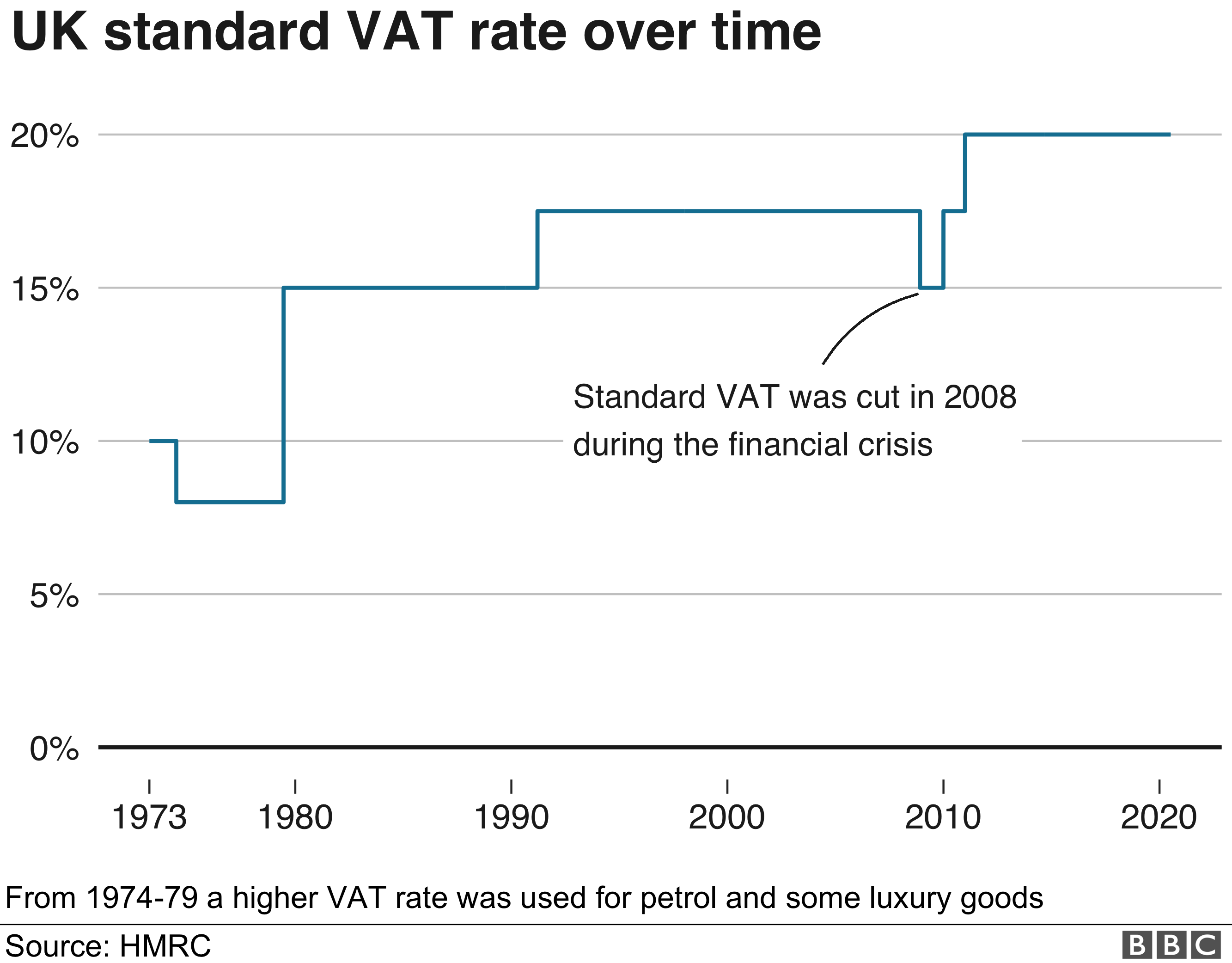

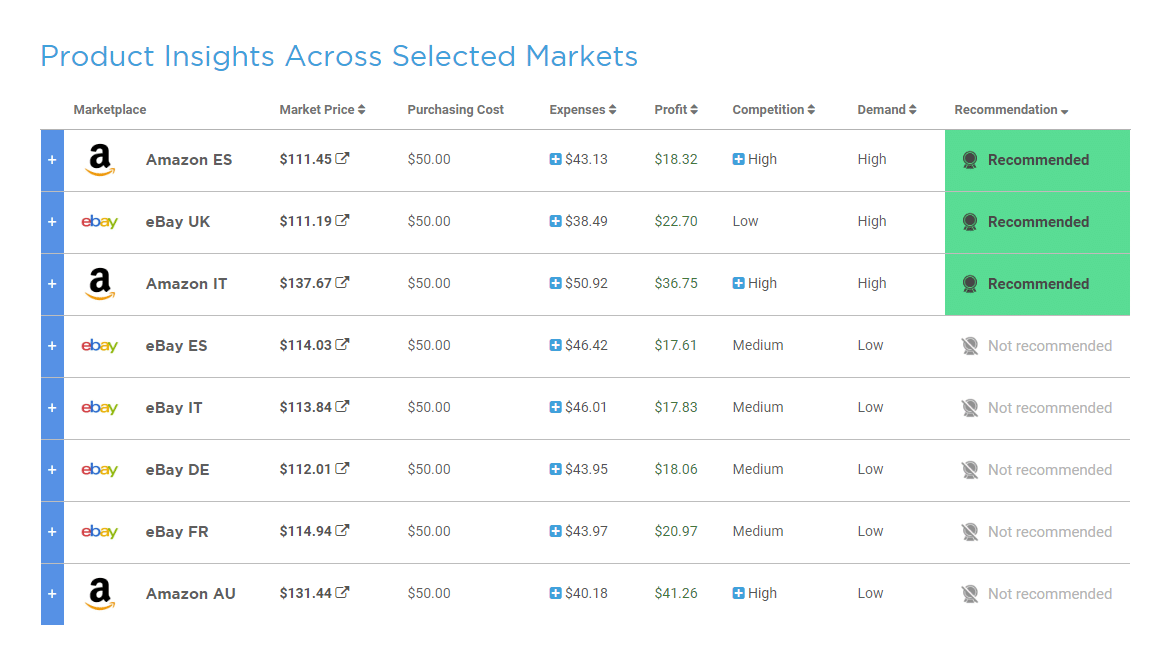

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

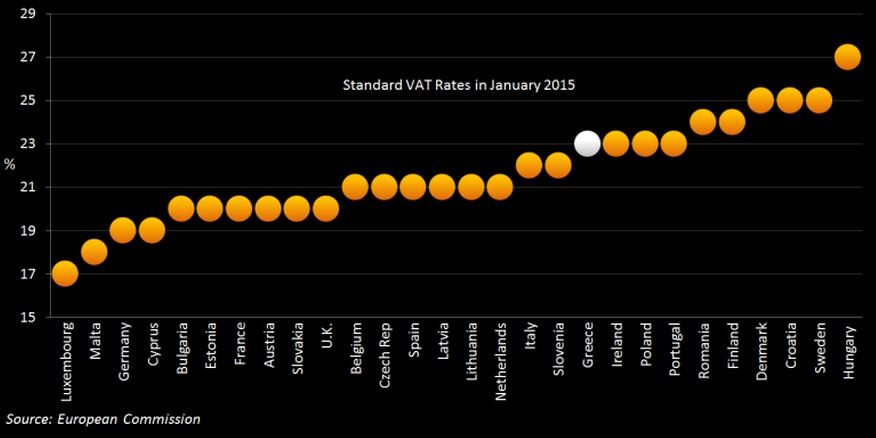

Why Greece's VAT increase is unlikely to work, Insights

What is the difference between sales tax and VAT?

Value Added Tax (VAT) - Overview, How To Calculate, Example

Taxes on Selling Stock: What You Pay & How to Pay Less

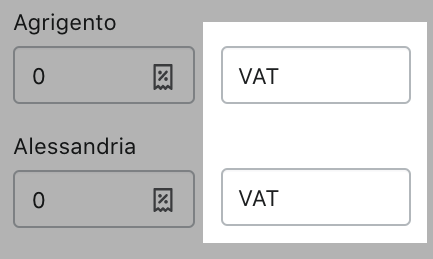

Shopify Help Center Location-based tax settings

Value-Added Tax (VAT): Definition, Who Pays - NerdWallet

:max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg)

Value-Added Tax (VAT)

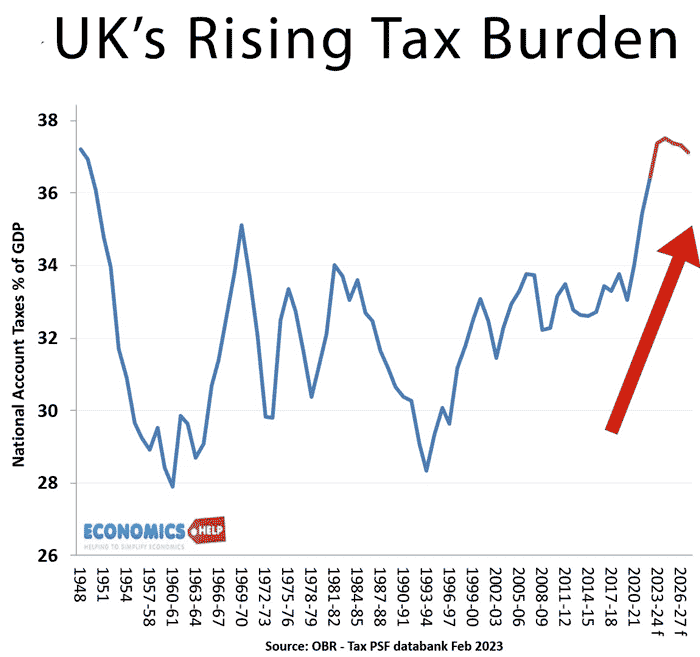

Effects of taxes and benefits on UK household income - Office for National Statistics

Why the UK Faces Higher Taxes and Less Public Services - Economics Help

Tax Incidence: How the Tax Burden is Shared Between Buyers and Sellers

What is VAT and how does it work?

The effect of tax cuts on economic growth and revenue - Economics Help

The effect of tax cuts on economic growth and revenue - Economics Help

Recomendado para você

-

offers free 'online shop window' for SMEs during lockdown - Toy World Magazine, The business magazine with a passion for toysToy World Magazine29 março 2025

offers free 'online shop window' for SMEs during lockdown - Toy World Magazine, The business magazine with a passion for toysToy World Magazine29 março 2025 -

Online Selling - ECommerce - ASCOM29 março 2025

Online Selling - ECommerce - ASCOM29 março 2025 -

launches UK 'Your Shopping Universe' campaign - Inc.29 março 2025

launches UK 'Your Shopping Universe' campaign - Inc.29 março 2025 -

Dangerous listings can be removed by regulators - BBC News29 março 2025

Dangerous listings can be removed by regulators - BBC News29 março 2025 -

opens physical pop-up store to reinvent the UK high street - Elite Business Magazine29 março 2025

opens physical pop-up store to reinvent the UK high street - Elite Business Magazine29 março 2025 -

Unlock Global Shipping UK with forward2me29 março 2025

Unlock Global Shipping UK with forward2me29 março 2025 -

UK Seller Tool29 março 2025

UK Seller Tool29 março 2025 -

New Apple iPhone 11 64GB Purple MWLX2B/A LTE 4G Sim Free Unlocked29 março 2025

New Apple iPhone 11 64GB Purple MWLX2B/A LTE 4G Sim Free Unlocked29 março 2025 -

Lokal shopping launched in Germany - ChannelX29 março 2025

Lokal shopping launched in Germany - ChannelX29 março 2025 -

and lose UK shoppers to Shein and Temu29 março 2025

and lose UK shoppers to Shein and Temu29 março 2025

você pode gostar

-

Vídeo de Pokémon Legends: Arceus dá pistas sobre os monstrinhos de29 março 2025

Vídeo de Pokémon Legends: Arceus dá pistas sobre os monstrinhos de29 março 2025 -

Mewing: La técnica viral para afilar tu rostro sin cirugía y29 março 2025

Mewing: La técnica viral para afilar tu rostro sin cirugía y29 março 2025 -

Jason Ferrer - Field Support Representative - Maxar Technologies29 março 2025

-

How Donatella took Versace to new heights after Gianni's death – from that Fendi collab and Jennifer Lopez' iconic green dress, to the brand's multibillion-dollar acquisition by Michael Kors29 março 2025

How Donatella took Versace to new heights after Gianni's death – from that Fendi collab and Jennifer Lopez' iconic green dress, to the brand's multibillion-dollar acquisition by Michael Kors29 março 2025 -

Kenneth - Roblox29 março 2025

-

10 animes que prometem fazer sucesso em 202329 março 2025

10 animes que prometem fazer sucesso em 202329 março 2025 -

Pokémon TCG Value Watch: Pokémon GO In July 202329 março 2025

Pokémon TCG Value Watch: Pokémon GO In July 202329 março 2025 -

Assassin's Creed III Remastered Review - Gamereactor29 março 2025

Assassin's Creed III Remastered Review - Gamereactor29 março 2025 -

Pin by HSHS VisualArts on Stickman29 março 2025

Pin by HSHS VisualArts on Stickman29 março 2025 -

Topg Andrew Tate Version Logo Stock Vector (Royalty Free29 março 2025

Topg Andrew Tate Version Logo Stock Vector (Royalty Free29 março 2025