CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Por um escritor misterioso

Last updated 05 abril 2025

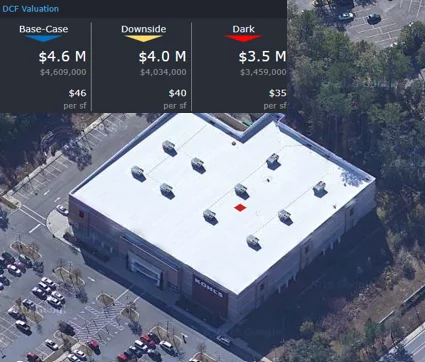

Key Takeaways: Kohl’s plans to open smaller stores and transition away from department store formatThe highest concentration of Kohl’s lease expirations occurs in 2024 impacting $815 million in CMBS debtCMBS exposure to Kohl’s totals approximately $5 billion Speculation surrounding Kohl’s and its future as a public company has been active during Q1 2022. In early-March

8-15-14

1hU4B0O

News Hamilton Pacific Real Estate Group, Inc.

CMBS vs. CRE CLO: An evolving matchup

Lock In Your Bets: 22 Commercial Real Estate Trends To Expect In 2018

Unlocking Value: CMBS and Accurate Commercial Property Appraisal - FasterCapital

Clear Capital Clear Capital Admin

CMBS and Commercial Real Estate Implications of a Kohl's Takeover

Kohl's Fields Takeover Offers Despite Low Customer Foot Traffic in 2021 – Commercial Observer

Recomendado para você

-

Kohl's quietly opens its new downtown Milwaukee store Sunday: Slideshow - Milwaukee Business Journal05 abril 2025

Kohl's quietly opens its new downtown Milwaukee store Sunday: Slideshow - Milwaukee Business Journal05 abril 2025 -

20 best Sephora deals at Kohl's to shop now05 abril 2025

20 best Sephora deals at Kohl's to shop now05 abril 2025 -

Kohl's location in Forney scheduled for grand opening on Nov. 3, Business05 abril 2025

Kohl's location in Forney scheduled for grand opening on Nov. 3, Business05 abril 2025 -

Kohl's announces opening date for Morgantown store05 abril 2025

Kohl's announces opening date for Morgantown store05 abril 2025 -

Kohl's to open smallest of its small-format 'concept' stores this week - Milwaukee Business Journal05 abril 2025

Kohl's to open smallest of its small-format 'concept' stores this week - Milwaukee Business Journal05 abril 2025 -

Why Hudson's Bay Co. Wants Kohl's Corp. – WWD05 abril 2025

Why Hudson's Bay Co. Wants Kohl's Corp. – WWD05 abril 2025 -

Is Kohl's Open on Thanksgiving?05 abril 2025

Is Kohl's Open on Thanksgiving?05 abril 2025 -

Kohl's Military Discount Gets Better Through Veterans Day Weekend05 abril 2025

Kohl's Military Discount Gets Better Through Veterans Day Weekend05 abril 2025 -

Kohl's reports fiscal Q1 results that miss analysts' expectations, cuts earnings forecast05 abril 2025

Kohl's reports fiscal Q1 results that miss analysts' expectations, cuts earnings forecast05 abril 2025 -

Kohl's Shopping Hacks: 15 Ways to Save Money05 abril 2025

você pode gostar

-

One Piece Luffy Gear 4 Bounce Man Straw Hat Pirate T-shirt, hoodie05 abril 2025

One Piece Luffy Gear 4 Bounce Man Straw Hat Pirate T-shirt, hoodie05 abril 2025 -

Ghost of Tsushima's Co-Op Mode is A Brand New Game05 abril 2025

Ghost of Tsushima's Co-Op Mode is A Brand New Game05 abril 2025 -

Streaming: O que preciso para fazer lives?05 abril 2025

Streaming: O que preciso para fazer lives?05 abril 2025 -

Nomes femininos! #femininos #freefire #freefire_lover #free_fire #meni05 abril 2025

-

Screenagers Blog Video Gaming “Among Us” Advice05 abril 2025

Screenagers Blog Video Gaming “Among Us” Advice05 abril 2025 -

Moltres Pokédex05 abril 2025

Moltres Pokédex05 abril 2025 -

Dante's Inferno « KaiserScience05 abril 2025

Dante's Inferno « KaiserScience05 abril 2025 -

160+ Ludo Jogo De Tabuleiro Ilustração de stock, gráficos vetoriais e clipart royalty-free - iStock05 abril 2025

160+ Ludo Jogo De Tabuleiro Ilustração de stock, gráficos vetoriais e clipart royalty-free - iStock05 abril 2025 -

Descendants of The Sun Best Korean Drama OST Full Album05 abril 2025

Descendants of The Sun Best Korean Drama OST Full Album05 abril 2025 -

Mini Mesa De Ping Pong Barato05 abril 2025

Mini Mesa De Ping Pong Barato05 abril 2025