Are Gift Cards Taxable to Employees?

Por um escritor misterioso

Last updated 20 março 2025

Are gift cards taxable? If your business purchases gift cards for employees, make sure you’re not missing this important reporting step.

Can I Give My Employee a Gift Card Without Being Taxed?

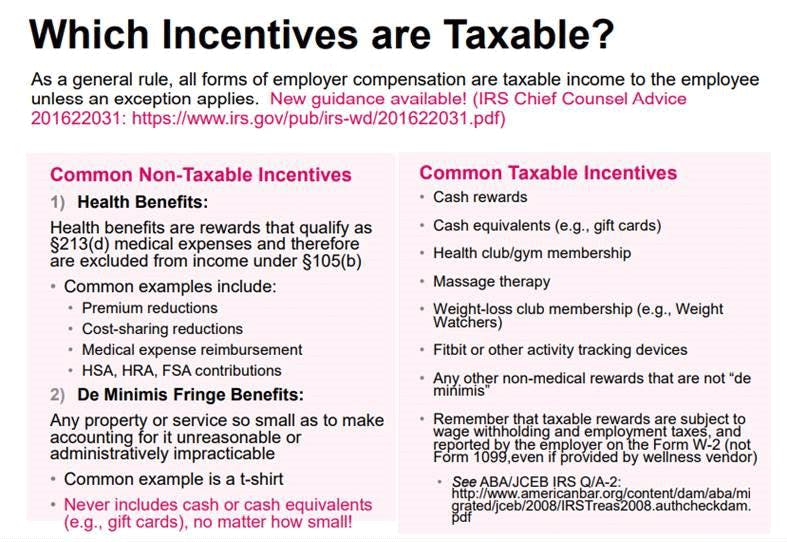

Are gift cards taxable employee benefits?

Taxation of Wellness Program Gift Cards

Our Top 24 Gift Cards for Employee Appreciation Presents

The Tax Implications of Employee Gifts - Hourly, Inc.

The Tax Implications of Employee Gifts: An Easy Guide for U.S. Employers

Employee Gift Cards, Best in 2023

If I earn gift cards for taking online surveys, is it considered taxable income? Do I need to report this income if I do not receive a 1099-MISC? - Quora

Are gift cards taxable income to employees?

Are gift cards taxable?

Are Employee Gift Cards Taxable?

Are gift cards taxable employee benefits?

Employee Gifts: What You Need to Know From a Tax Perspective

Recomendado para você

-

:max_bytes(150000):strip_icc()/creative-gift-exchange-games-d2ddc82e635e445186d9ae6c8bce499c.png) 30+ Gift Exchange Ideas—Including Games, Traditions, and Tips20 março 2025

30+ Gift Exchange Ideas—Including Games, Traditions, and Tips20 março 2025 -

89 Best DIY Christmas Gifts 2023: How to Make Easy Gifts at Home20 março 2025

89 Best DIY Christmas Gifts 2023: How to Make Easy Gifts at Home20 março 2025 -

What the Gifts You Give Reveal About You - The Atlantic20 março 2025

What the Gifts You Give Reveal About You - The Atlantic20 março 2025 -

Gift Card, For Online Purchases!20 março 2025

Gift Card, For Online Purchases!20 março 2025 -

Preferred Customer Benefits - Free Gift with Purchase20 março 2025

Preferred Customer Benefits - Free Gift with Purchase20 março 2025 -

168 Unique Corporate Gift Ideas (December 2023)20 março 2025

168 Unique Corporate Gift Ideas (December 2023)20 março 2025 -

30 Subscription Gifts You Can Send Last-Minute 202320 março 2025

30 Subscription Gifts You Can Send Last-Minute 202320 março 2025 -

Holiday & Christmas Gift Ideas - Target20 março 2025

-

47 best gag gifts to make anyone laugh in 2023 - TODAY20 março 2025

47 best gag gifts to make anyone laugh in 2023 - TODAY20 março 2025 -

Receiving Gifts Love Language In Relationships20 março 2025

Receiving Gifts Love Language In Relationships20 março 2025

você pode gostar

-

Kit 2 Beyblade + 2 Lançadorer + Arena - Promoção Barato20 março 2025

Kit 2 Beyblade + 2 Lançadorer + Arena - Promoção Barato20 março 2025 -

Contest Pokémon! - Jogo - Fórum otPokémon - Pokémon Online20 março 2025

Contest Pokémon! - Jogo - Fórum otPokémon - Pokémon Online20 março 2025 -

Maristela Vaz (@MaristelaVaz8) / X20 março 2025

Maristela Vaz (@MaristelaVaz8) / X20 março 2025 -

Piercings na boca: 15 modelos para você se inspirar20 março 2025

Piercings na boca: 15 modelos para você se inspirar20 março 2025 -

Lala Satalin Deviluke To love ru darkness, To love ru, Anime20 março 2025

Lala Satalin Deviluke To love ru darkness, To love ru, Anime20 março 2025 -

US woman adopts girl with Down syndrome from India; heart-warming video shows glimpses of their year together20 março 2025

US woman adopts girl with Down syndrome from India; heart-warming video shows glimpses of their year together20 março 2025 -

How To Draw A Pop It Toy20 março 2025

How To Draw A Pop It Toy20 março 2025 -

Meta Quest Promo Code: 28% Off → December 202320 março 2025

Meta Quest Promo Code: 28% Off → December 202320 março 2025 -

baby lamb in a green field, pixar, 3 d model,, Stable Diffusion20 março 2025

baby lamb in a green field, pixar, 3 d model,, Stable Diffusion20 março 2025 -

Why Anime Should Be Included in Emmy's Animated Program Competition – Awardsdaily20 março 2025

Why Anime Should Be Included in Emmy's Animated Program Competition – Awardsdaily20 março 2025