2021 FICA Tax Rates

Por um escritor misterioso

Last updated 31 dezembro 2024

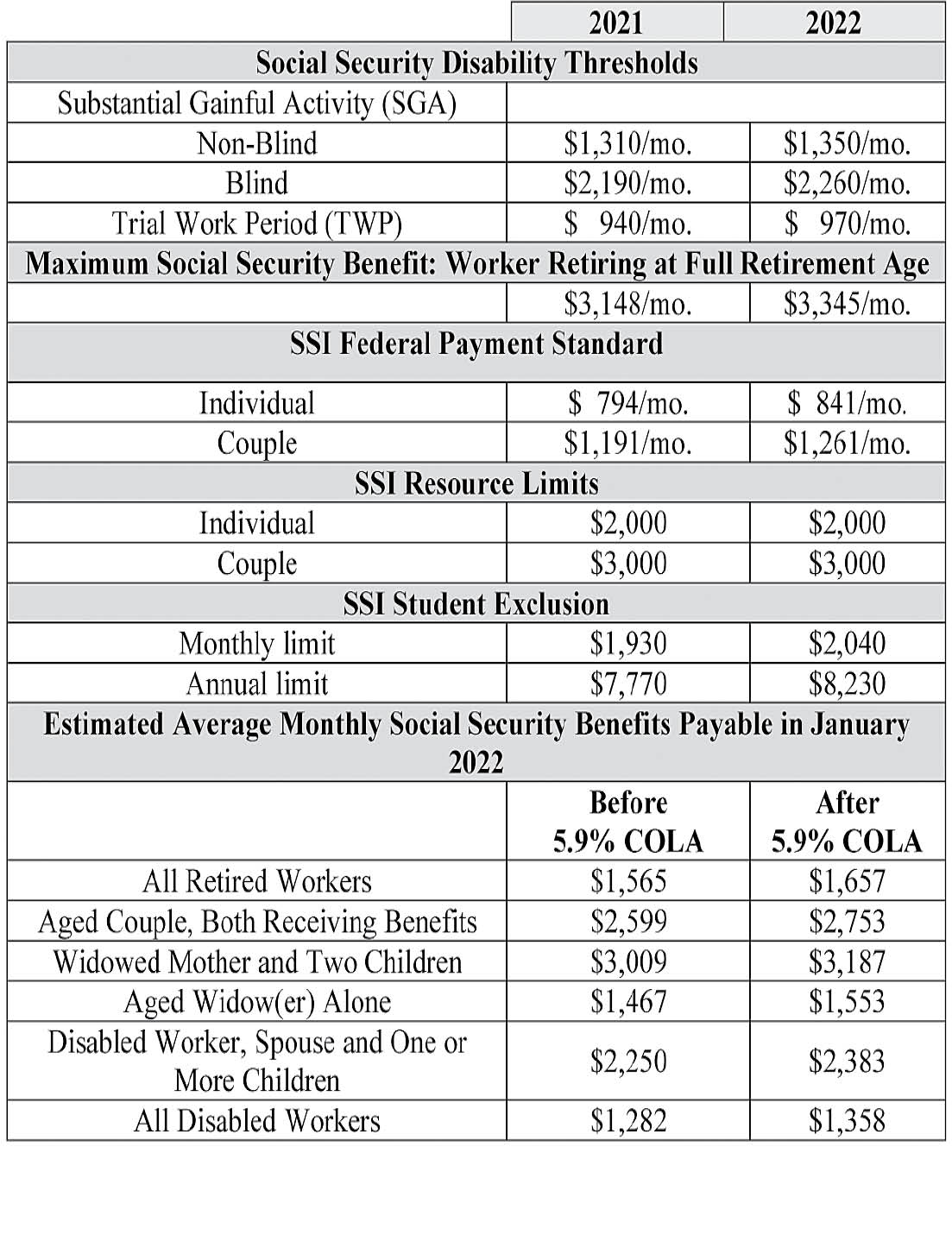

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Uncapping the Social Security Tax – People's Policy Project

YOUR SOCIAL SECURITY Davenport, Iowa Office

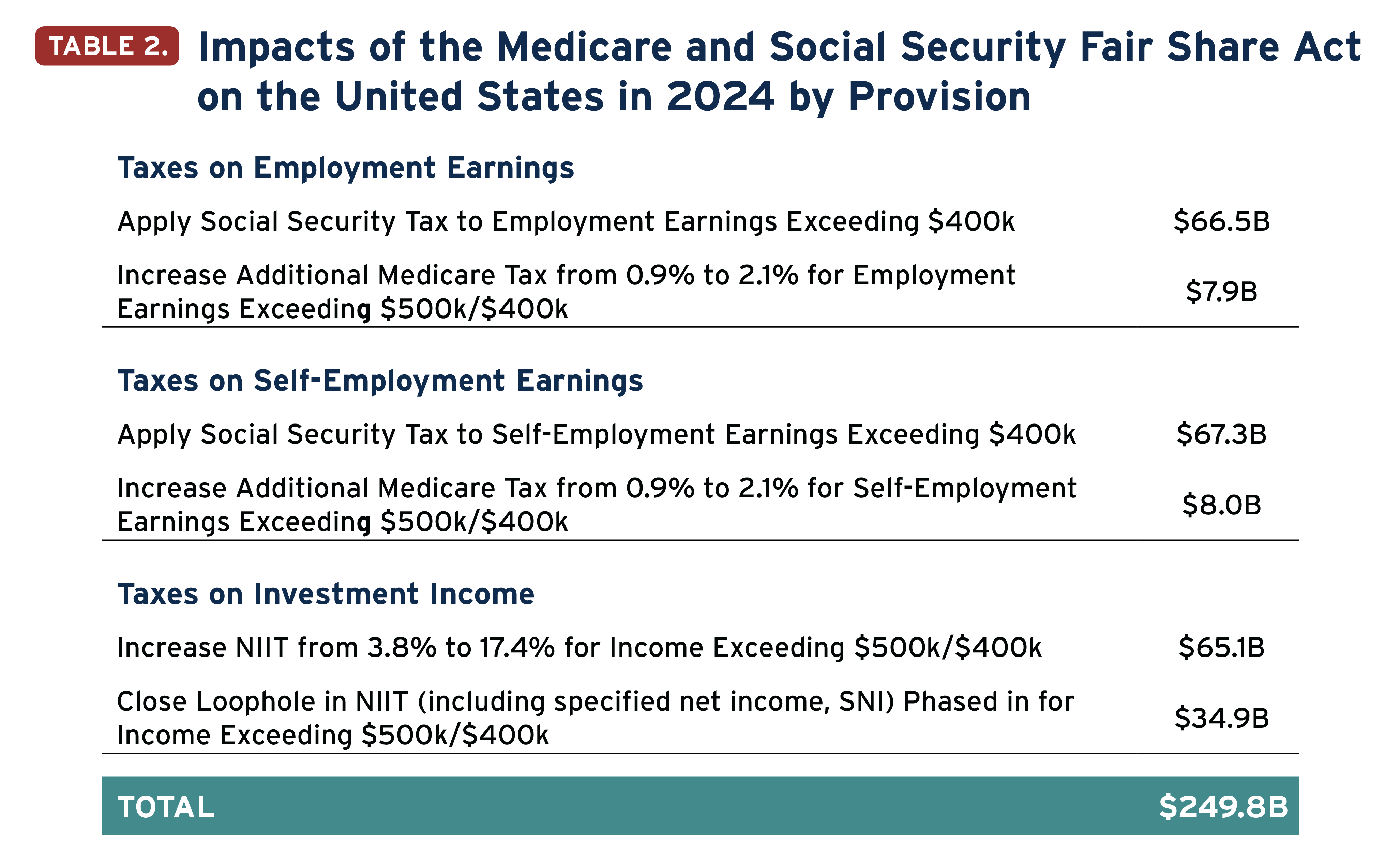

Fair Share Act' Would Strengthen Medicare and Social Security Taxes – ITEP

Social Security and Taxes – Could There Be a Tax Torpedo in Your Future?

Financial Considerations for Moonlighting Physicians

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Understanding Medicare Tax

Understanding FICA and How It Affects Your Primary Insurance Amount - FasterCapital

States That Tax Social Security Benefits

2021 Wage Base Rises for Social Security Payroll Taxes

Social Security tax impact calculator - Bogleheads

FICA tax rate 2022: How can you adjust you Social Security and Medicare taxes?

Federal Insurance Contributions Act - Wikipedia

Taxes – Payroll taxes, especially Social Security, are regressive … NOT !!!

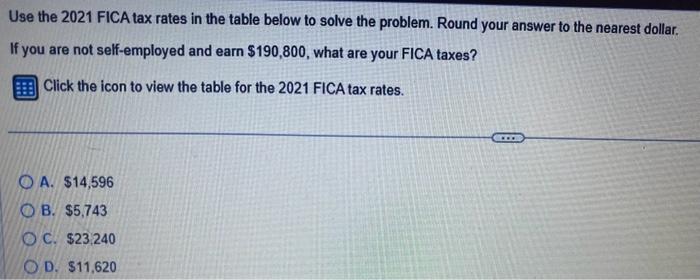

Solved Use the 2021 FICA tax rates in the table below to

Recomendado para você

-

What is FICA31 dezembro 2024

What is FICA31 dezembro 2024 -

FICA Tax Rate: What is the percentage of this tax and how you can calculated?31 dezembro 2024

FICA Tax Rate: What is the percentage of this tax and how you can calculated?31 dezembro 2024 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes31 dezembro 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes31 dezembro 2024 -

What is the FICA Tax and How Does it Connect to Social Security?31 dezembro 2024

-

What Are FICA Taxes And Do They Affect Me?, by M. De Oto31 dezembro 2024

What Are FICA Taxes And Do They Affect Me?, by M. De Oto31 dezembro 2024 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student31 dezembro 2024

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student31 dezembro 2024 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.31 dezembro 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.31 dezembro 2024 -

2019 US Tax Season in Numbers for Sprintax Customers31 dezembro 2024

2019 US Tax Season in Numbers for Sprintax Customers31 dezembro 2024 -

FICA Tax Tip Fairness Pro Beauty Association31 dezembro 2024

FICA Tax Tip Fairness Pro Beauty Association31 dezembro 2024 -

What Is FICA Tax, Understanding Payroll Tax Requirements31 dezembro 2024

What Is FICA Tax, Understanding Payroll Tax Requirements31 dezembro 2024

você pode gostar

-

The meaning of Memorial Day –31 dezembro 2024

The meaning of Memorial Day –31 dezembro 2024 -

pokemon randomizer team|TikTok Search31 dezembro 2024

pokemon randomizer team|TikTok Search31 dezembro 2024 -

Nico di Angelo Goth Hades Camp Half Blood Shirt 2 | Essential T-Shirt31 dezembro 2024

Nico di Angelo Goth Hades Camp Half Blood Shirt 2 | Essential T-Shirt31 dezembro 2024 -

Jogos Pedagógicos para Habilidades Cognitivas 2023 • Pedagogia de Ideias31 dezembro 2024

Jogos Pedagógicos para Habilidades Cognitivas 2023 • Pedagogia de Ideias31 dezembro 2024 -

Speed Clicker APK for Android Download31 dezembro 2024

Speed Clicker APK for Android Download31 dezembro 2024 -

The Eminence in Shadow – 20 (Fin) – Just Getting Started – RABUJOI31 dezembro 2024

The Eminence in Shadow – 20 (Fin) – Just Getting Started – RABUJOI31 dezembro 2024 -

More People Are Playing Red Dead Redemption 2 on Steam Now Than Ever Before31 dezembro 2024

More People Are Playing Red Dead Redemption 2 on Steam Now Than Ever Before31 dezembro 2024 -

![648 - Shiny [Meloetta] Pirouette Forme.png - Generation 7 - QR](https://projectpokemon.org/home/uploads/monthly_2018_09/large.1953271317_648-ShinyMeloettaPirouetteForme.png.703738734e016786a41e2eb4d5880846.png) 648 - Shiny [Meloetta] Pirouette Forme.png - Generation 7 - QR31 dezembro 2024

648 - Shiny [Meloetta] Pirouette Forme.png - Generation 7 - QR31 dezembro 2024 -

Aesthetic Vibes Wallpapers - Top Free Aesthetic Vibes Backgrounds31 dezembro 2024

Aesthetic Vibes Wallpapers - Top Free Aesthetic Vibes Backgrounds31 dezembro 2024 -

Entre Nós Crazy Shooter-Jogo De Tiro - Click Jogos 36031 dezembro 2024

Entre Nós Crazy Shooter-Jogo De Tiro - Click Jogos 36031 dezembro 2024